At the time of liquidation of company, a very important statement is made for showing estimated realizable value and liabilities expected to rank. That statement is called statement of affairs. To prepare statement of affairs is also important because by making statement of affairs we can know what amount of surplus or deficiency in balance. Company act 1956 has given its format. Different items are estimated as per different lists. Now, we are preparing and explaining statement of affairs according to list of assets and liabilities. You should remember statement of affairs all item thoroughly. Difference between the estimated value of assets and liabilities will be estimated value of surplus or deficiency.

1. List A : Assets not specifically pledged

First of all, we make the list of assets which are not on pledge. you should not take any loan by giving these assets as security. We write these assets' estimated realizable value instead of book value because creditors are interested to know what amount will they receive after selling of these assets in market. Value of call in area will be assets under list A.In these assets, we can include

i) Balance at bank

ii)) Cash in hand

iii) Marketable Securities

iv) Bills Receivable

v) Trade Debtors

vi) Loan and Advance

vii) Unpaid calls

viii) Stock in trade

ix) Freehold property

x) Leasehold property

xi) Plant and property

xii) Furniture Fittings, Utensils etc

xiii) Investment other than marketable securities

xiv ) Livestock

xv) Other property

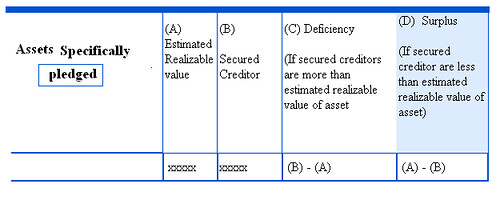

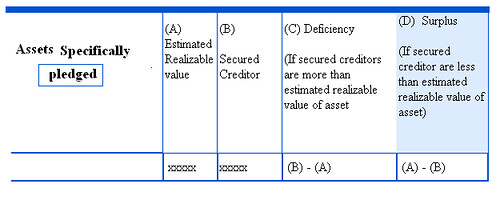

2. List B : Assets Specifically Pledged

In list B, we include estimated realizable value of all the assets specially mortgaged, pledged, or otherwise given as security. We also classify these pledged assets into under possession of company and not under the possession of company. We will calculate surplus or deficiency after deducting these assets' estimated realizable value from amount of secured loan and then adjusted it in estimated realizable value of assets which are not pledged.

3. List C : Preferential Creditors

Now, we deduct preference creditors of list C from the total of List A and List B amount

4. List D : Debenture holders Secured by a floating charges

The balance after deducting list c preference creditors is used for deducting the amount of debentures secured by a floating charges and its payable interest.

5. List E : Unsecured Creditors

The balance of assets after deducting list d debenture holders amount is used for deducting the amount of unsecured creditors.

6. List F : Preference Shares

In this list, we include all the payable amount of preference shares which is deducted from realizable asset's balance after deducting list E's liability.

7. List G : Equity Shares

In this list, we include all the payable amount of equity shareholders which is deducted from realizable asset's balance after deducting List F's liability. For calculating equity shares exact value, we deduct irrecoverable unpaid calls.

8. List H : Surplus or Deficiency

Balance will be surplus or deficiency which will be included in list H

1. List A : Assets not specifically pledged

First of all, we make the list of assets which are not on pledge. you should not take any loan by giving these assets as security. We write these assets' estimated realizable value instead of book value because creditors are interested to know what amount will they receive after selling of these assets in market. Value of call in area will be assets under list A.In these assets, we can include

i) Balance at bank

ii)) Cash in hand

iii) Marketable Securities

iv) Bills Receivable

v) Trade Debtors

vi) Loan and Advance

vii) Unpaid calls

viii) Stock in trade

ix) Freehold property

x) Leasehold property

xi) Plant and property

xii) Furniture Fittings, Utensils etc

xiii) Investment other than marketable securities

xiv ) Livestock

xv) Other property

2. List B : Assets Specifically Pledged

In list B, we include estimated realizable value of all the assets specially mortgaged, pledged, or otherwise given as security. We also classify these pledged assets into under possession of company and not under the possession of company. We will calculate surplus or deficiency after deducting these assets' estimated realizable value from amount of secured loan and then adjusted it in estimated realizable value of assets which are not pledged.

3. List C : Preferential Creditors

Now, we deduct preference creditors of list C from the total of List A and List B amount

4. List D : Debenture holders Secured by a floating charges

The balance after deducting list c preference creditors is used for deducting the amount of debentures secured by a floating charges and its payable interest.

5. List E : Unsecured Creditors

The balance of assets after deducting list d debenture holders amount is used for deducting the amount of unsecured creditors.

6. List F : Preference Shares

In this list, we include all the payable amount of preference shares which is deducted from realizable asset's balance after deducting list E's liability.

7. List G : Equity Shares

In this list, we include all the payable amount of equity shareholders which is deducted from realizable asset's balance after deducting List F's liability. For calculating equity shares exact value, we deduct irrecoverable unpaid calls.

8. List H : Surplus or Deficiency

Balance will be surplus or deficiency which will be included in list H

No comments:

Post a Comment