Investment Accounting - Ist part

☼ What is Investment ?

Investment are those assets of businessman by which he earn dividend , interest , rent or profit due to increase the value of investment .

Current stock is not called investment because businessman purchases them for selling, in other words, the do business of that stock.

Generally businessman invests money in property and building so, these are the basic investments.

According to Accounting Standard 13 “Investment is the assets held by enterprise for earning income by way of dividends, interest and rent."

☼ Types of Investment

Investment may be short term or long term.

We can also include shares, debentures, and bonds and mutual funds of othercompany, if we purchase them for the purpose of earning of interest or dividend from them.

☼ Type of Business

1. Commodity business: - These are general type of business which deal in products but invests his extra money in different property, shares and bonds.

2. Financial business: - If any business which deal in the trading of shares, or debentures or any other fixed property. Then his work is to purchase and sale of such product and earn profit from them. This is special case . According to AS -13 , at this time , these products will deem as his stock item not investment .

☼ Com- Interest Investment

When a businessman buys investment include its cost and accrued interest . Then this investment is called com-interest investment .

So it is the duty of accountant to separate both .

Calculation of accrued interest = face value of security purchase X period( months )

______________________________

12 X 100

Calculation of cost of investment = ( Quotation price X No. of security purchase ) – Accrued interest as per calculated

☼ Ex- Interest Investment

When businessman buys investment on its cost and gives accrued interest amount extra to the seller .

☼ Nominal Value

Nominal Value is face value of security . This is so important in investment accounting . Because interest is calculated on nominal value of security .

Investment Accounting -2nd Part

1. When investment is purchased interest date

Investment account Debit ( Quoted price + brokerage ) X No. of investment

bank account Credit

2. When interest or dividend is received after purchase

Bank Account Debit

Investment Account Credit

3. When investment is sold at interest date

Bank Account debit

investment account Credit

4. For transfer of interest or dividend to profit and loss account at the end of year ( but there is no need to enter this entry in tally 9 because tally 9 automatically transfer to profit and loss account )

Interest account or dividend account debit

Profit and loss account credit

5. Pass the journal entry of profit on sale of investment in manual or tally 9 both

Investment Account Debit

Profit and loss account Credit

6. At end of year show investment at cost price or market price which is less as asset in balance sheet ( but need no do in tally 9)

Example

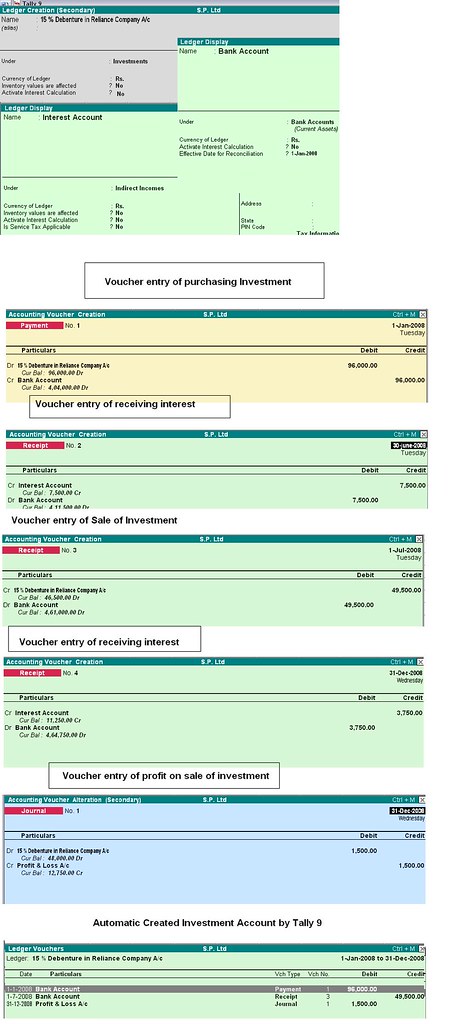

On 1st jan 2008 S.P. Ltd purchase 1000 15 % debentures of Reliance Ltd. Of Rs. 100 each @ Rs. 96 each . On 1st july 2008 , ½ of debentures were sold at Rs. 99 each . Debenture interest is payable half yearly on 30th june and 31st December . Pass voucher entries in tally 9

Working notes

1) Interest on 30th june 2008 will be received 15% on Rs 100000 for 6 months interest = Rs. 100000 X 15/100 X 6/12 = Rs. 7500

2) ½ of debentures were sold @ Rs. 99 . Therefore sale proceeds will be Rs. 99 X 500 = Rs. 49500

3) Interest on 31st December 2008 will be received @ 15% on Rs. 50000 for 6 months . Interest = Rs. 50000 X 15/100 X 6/12 = Rs. 3750

4) profit on sale of investment = 49500-48000 = Rs. 1500

For recording above transaction in tally 9

1) First of all create S.P. Ltd in tally 9

2) Activate interest calculation in feature F11

3) Create ledger of 15 Debenture in reliance Co. account under investment account , bank account under bank account , Interest account under indirect income .

4) Pass the voucher entry of purchasing investment in payment voucher, sale of investment in receipt voucher and interest received on investment is in receipt voucher and profit on sale of investment transfer to profit and loss account in journal voucher .

No comments:

Post a Comment