Inventory turnover ratio is useful for checking the efficiency of stock. It is also improvement of current ratio. Sometime current ratio may mislead use when there is slow movement of stock in to sale. But inventory turnover ratio will give more idea about, how should we keep our stock in store.

Inventory turnover ratio is relationship between cost of goods sold or net sales and average inventory. This ratio is also known as stock velocity. This ratio tells us whether we use of stock efficiently or not. This ratio will be in times. It tells us the times of sales of every time of stock bought.

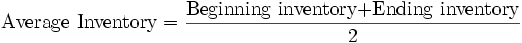

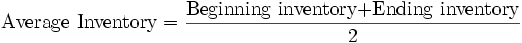

Formula

or

ITR = Net Sales / Average Inventory at Cost

Inventory Turnover Ratio = 300000 / 30000 = 10 times

Analysis on the Basis of Inventory Turnover Ratio

1. There is no rule of thumb of inventory turnover ratio but inventory turnover ratio should be optimum. It should not be very higher or very lower.

2. A lower inventory turnover ratio is not good. Because at this level, we are increasing inventory but our sale is not increasing. Due to not converting inventory into sale, we have to keep our stock in our store and we have to face its cost which may be main cause of decreasing our profit. So, we earnestly say you, if you see lower inventory turnover ratio, you should decrease inventory and take good steps to increase your sale. For example, you net sales is just $ 50000 and your average inventory is $ 100000. It means ITR is just 0.5 times. So, this is not good. Try to improve it.

3. A higher inventory turnover ratio is good because higher ITR tells us that our number of time of total sales is more than number of times inventory has been bought. A higher ITR means low investment in inventory and higher return on this investment. But very higher ITR is not good because at this time our inventory may be too low. Due to shortage of low inventory, we may face the problem of loss of new sales orders or our supply may delay of sending us the stock. So, remember this point also.

Inventory turnover ratio is relationship between cost of goods sold or net sales and average inventory. This ratio is also known as stock velocity. This ratio tells us whether we use of stock efficiently or not. This ratio will be in times. It tells us the times of sales of every time of stock bought.

Formula

or

ITR = Net Sales / Average Inventory at Cost

Inventory Turnover Ratio = 300000 / 30000 = 10 times

Analysis on the Basis of Inventory Turnover Ratio

1. There is no rule of thumb of inventory turnover ratio but inventory turnover ratio should be optimum. It should not be very higher or very lower.

2. A lower inventory turnover ratio is not good. Because at this level, we are increasing inventory but our sale is not increasing. Due to not converting inventory into sale, we have to keep our stock in our store and we have to face its cost which may be main cause of decreasing our profit. So, we earnestly say you, if you see lower inventory turnover ratio, you should decrease inventory and take good steps to increase your sale. For example, you net sales is just $ 50000 and your average inventory is $ 100000. It means ITR is just 0.5 times. So, this is not good. Try to improve it.

3. A higher inventory turnover ratio is good because higher ITR tells us that our number of time of total sales is more than number of times inventory has been bought. A higher ITR means low investment in inventory and higher return on this investment. But very higher ITR is not good because at this time our inventory may be too low. Due to shortage of low inventory, we may face the problem of loss of new sales orders or our supply may delay of sending us the stock. So, remember this point also.

No comments:

Post a Comment