when you create a new company in tally 9 , after creating new company select this company by going to company info and then in the place of gateway of tally 9 you will see account info , click it and then go to ledger and then create the following ledger

- Sale account under the head of sale

- Purchase account under the head of Purchase

- Bank account under the head of bank

- Sale return account under the head of credit note

- Purchase return account under the head of Debit note

these are basic ledger which , you have to create before purchase and sale voucher entries.

Now come back to gate way of tally by click escape button

After this Click Inventory Info.

In inventory info you must create first unit of measurement ,it may kg , litre , meter , tonnes etc.

After this come back by esc and the create stock items in which you deal suppose in above example you can create stock item product1234

After this , you can pass the voucher entry . There are two way of passing voucher entry one is bill by bill wise and other is simple form .

In bill by bill mode , you do not understand about more journal entries . But you have write yes bill wise option in feature F11 if you want to choose first .

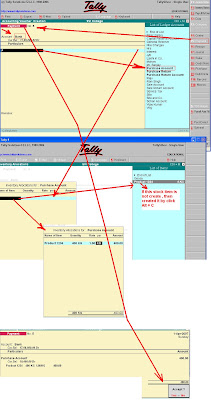

Just one the gate way of tally , you will see accounting vouchers , click it and then right side you will see different vouchers . Now , if you want to pass the voucher entry relating to purchase . Then decide , it is credit or cash or bank purchase , if , it is credit purchase , then click purchase in right side and after this in the account , you can create ledger of your creditor by passing short cut key of Alt+C and you will see new pop up box and create you new creditor account by mentioning his name and keep it under sundry creditors and accept it , after this you will see his account in the purchase voucher and the write the quantity and rate of purchased goods and then accept the voucher . If you want to purchase cash or through bank , then create bank account ledger first but there is no need of cash account because it is automatically created by tally 9 . But you have to pass the voucher entry in receipt voucher or if you have already made voucher type then you can select cash purchase in purchase voucher and pass the voucher entry.

Same procedure will apply for passing the voucher of sale transactions . If it is credit sale you have to make debtor account by giving the name of debtor and under the head of your debtor and then pass the voucher entry in sale voucher , if it is cash sale then it will be passed in receipt voucher . For passing the voucher entry of purchase return and sale return see here .

No comments:

Post a Comment